- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Up 140% in 2025, This Dividend Stock Is Still a Buy as Trump Takes on the Fed

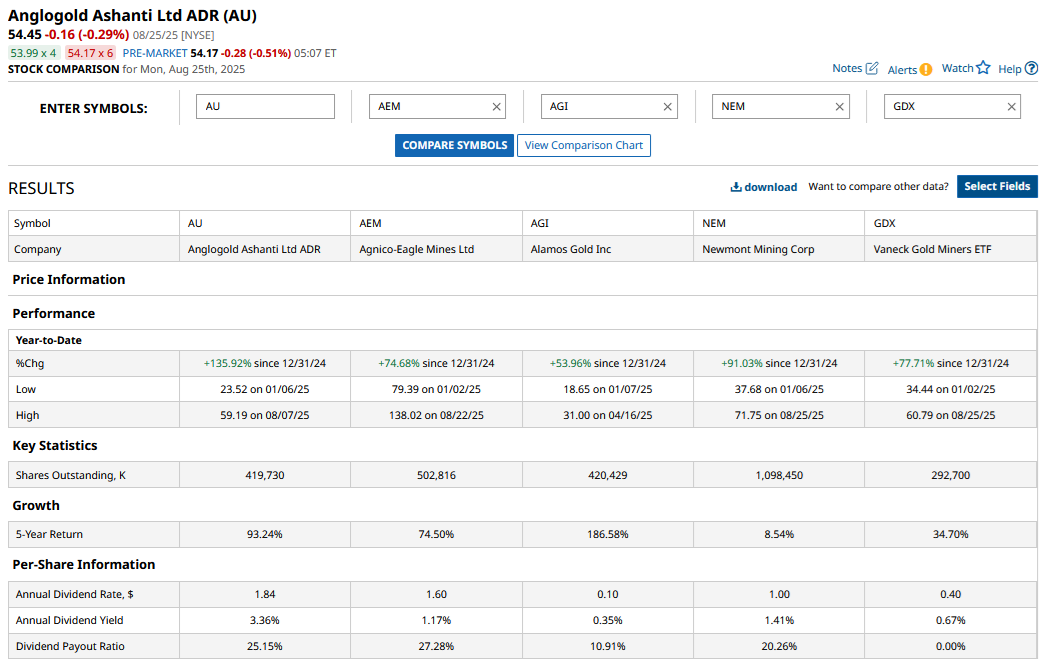

Anglogold Ashanti (AU) stock is up 140% in 2025, outperforming the VanEck Gold Miners ETF (GDX) by a significant margin. The stock has one of the most generous dividend policies among its peers, and its mammoth 2025 rally is far from over, as we’ll discuss in this article.

To be sure, I have been bullish on gold (GCZ25) – and by extension gold mining companies, which are a leveraged play on gold – for quite some time now. The bullishness has paid off well as both gold and gold mining companies have performed incredibly well this year. Specifically, AU stock has only built on its YTD gains since the last time I covered the company.

Why Gold’s Outlook Looks Positive

While the S&P 500 Index ($SPX) and Dow Jones Industrial Average Index ($DOWI) soared to a record high last week after Federal Reserve Chair Jerome Powell’s dovish pivot at the annual Jackson Hole Symposium, a disconnect has emerged between the stock markets and economic indicators, particularly those concerning the labor market. In light of this divergence, gold could be a perfect hedge, and the precious metal has soared (along with broader markets) for a reason this year.

While the structural outlook for gold looks positive amid the central bank buying spree, near unsustainable fiscal positions in many major economies, and structural geopolitical tensions, there are a few reasons to be tactically bullish in the short term. These include

- Monetary policy easing: Powell has signaled rate cuts, and a 25-basis point cut at next month’s Fed meeting looks like the most likely outcome. Since gold is a non-interest-bearing asset, rate cuts are theoretically positive for the yellow metal.

- Trump-Fed Tussle: On more than one occasion, most recently during his Jackson Hole speech, Powell has said that the Fed works without any political interference. However, the tussle between the Fed and President Donald Trump looks set to intensify after he removed Federal Reserve Board Governor Lisa Cook, who has questioned the president’s “authority to do so.” Central bank independence is a hallmark of all modern economies, and any signs to the contrary are negative for markets and Treasuries, while being a positive for gold.

- Tariff threats: The U.S. has issued draft rules putting 50% tariffs on India for the country’s purchase of Russian oil. Trump has also threatened China with 200% tariffs if the country curbs exports of rare earths. Additionally, the president has talked about higher tariffs on countries that have a digital tax targeting U.S. tech giants. While markets don’t really expect Trump to walk the talk (at least in entirety), the tariff threats are back, which are supportive of gold.

AU Has a Generous Dividend Policy

AU has a well-defined dividend policy and currently pays a quarterly payout of $0.125 per share. Additionally, it is committed to top up the dividend to pay 50% of its free cash flow to investors at the end of every year.

The company departed from this policy and announced an interim dividend of $0.80 during its Q2 earnings call earlier this month, which included the base dividend of $0.125 and the true-up payment to reach 50% of free cash flows in the first half. It attributed the exception to the “strength of (the company’s) cash flows and its confidence in the outlook.”

Responding to a question on whether the company is moving to a half-yearly true-up on dividends, CEO Alberto Calderon responded in the negative, calling it an “extraordinary moment” even as he added, “but they can repeat themselves.”

Looking at the current trajectory of gold prices, Anglogold Ashanti investors should get an even fatter dividend in the second half of the year as the company trues-up the dividend to meet its payout target.

Should You Buy AU Stock?

While AU investors might be rewarded with healthy dividends, the stock’s rally too looks far from over. Anglogold has capitalized on the gold price rally and had a net debt of only $92 million at the end of June, 92% lower than the corresponding period last year. The management will consider buybacks and deleveraging in the back half of the year, and soon enough, AU should have more cash than debt on its balance sheet.

Anglogold is working on improving its positioning on the global cost curve and has been optimizing its portfolio, selling stakes in some of its tier 2 assets, which by definition have higher per-unit costs. In Q2, around two-thirds of Anglogold Ashanti’s production and 80% of reserves were from tier 1 assets, and the company expects the share to rise further as Obuasi ramps up operations.

Anglogold Ashanti trades at a forward enterprise value-to-earnings before interest, tax, depreciation, and amortization (EV-to-EBITDA) of 5.22x. There is a potential for re-rating of gold miners amid the precious metal’s positive outlook. Moreover, the valuation gap between AU and its peers could narrow as the company further deleverages its balance sheet and optimizes its portfolio.

Overall, I remain bullish on AU for the remainder of the year, as the stock is among the best ways to play higher gold prices.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.